w

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-38503

Iterum Therapeutics plc

(Exact name of Registrant as specified in its Charter)

|

Ireland |

98-1283148 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

Block 2 Floor 3, Harcourt Centre,

Harcourt Street,

Dublin 2, Ireland

(Address of principal executive offices)

Not applicable

(Zip Code)

(+353) 1 903-8920

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Ordinary Shares, $0.01 par value per share |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the Registrant’s ordinary shares, $0.01 par value per share, on the Nasdaq Global Market on June 30, 2018, was $151,081,043.

The number of shares of Registrant’s Common Shares outstanding as of February 28, 2019 was 14,367,441.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference information from the definitive proxy statement for the Registrant’s 2019 Annual Meeting of Shareholders, which is expected to be filed with the Securities and Exchange Commission not later than 120 days after the Registrant’s fiscal year ended December 31, 2018.

|

I |

|

Page |

|

PART I |

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

32 |

|

|

Item 2. |

75 |

|

|

Item 3. |

76 |

|

|

Item 4. |

76 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

77 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

79 |

|

Item 7A. |

90 |

|

|

Item 8. |

91 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

116 |

|

Item 9A. |

116 |

|

|

Item 9B. |

116 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

117 |

|

|

Item 11. |

117 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

117 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

117 |

|

Item 14. |

117 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

118 |

|

|

Item 16 |

120 |

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

|

|

• |

our use of cash reserves; |

|

|

• |

the initiation, timing, progress and results of our preclinical studies and clinical trials, and our research and development programs; |

|

|

• |

our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; |

|

|

• |

our ability to advance product candidates into, and successfully complete, clinical trials; |

|

|

• |

the potential advantages of our product candidates; |

|

|

• |

the timing or likelihood of regulatory filings and approvals; |

|

|

• |

the commercialization of our product candidates, if approved; |

|

|

• |

our ability to draw down our second term loan with Silicon Valley Bank; |

|

|

• |

our manufacturing plans; |

|

|

• |

our sales, marketing and distribution capabilities and strategy; |

|

|

• |

market acceptance of any product we successfully commercialize; |

|

|

• |

the pricing, coverage and reimbursement of our product candidates, if approved; |

|

|

• |

the implementation of our business model, strategic plans for our business and product candidates; |

|

|

• |

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates; |

|

|

• |

our ability to enter into strategic arrangements, collaborations and/or commercial partnerships in the United States and other territories and the potential benefits of such arrangements; |

|

|

• |

our estimates regarding expenses, capital requirements and needs for additional financing; |

|

|

• |

our expectations regarding how far into the future our cash on hand will fund our ongoing operations; |

|

|

• |

our financial performance; and |

|

|

• |

developments relating to our competitors and our industry. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to new information, actual results or to changes in our expectations, except as required by law.

You should read this Annual Report and the documents that we have filed with the Securities and Exchange Commission, or SEC, as exhibits to this Annual Report with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

ii

This Annual Report also contains industry, market and competitive position data from our own internal estimates and research as well as industry and general publications and research surveys and studies conducted by third parties. Industry publications, studies, and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. The industry in which we operate is subject to a high degree of uncertainty and risks due to various factors, including those described in the section titled “Risk Factors.”

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

iii

PART I

Overview

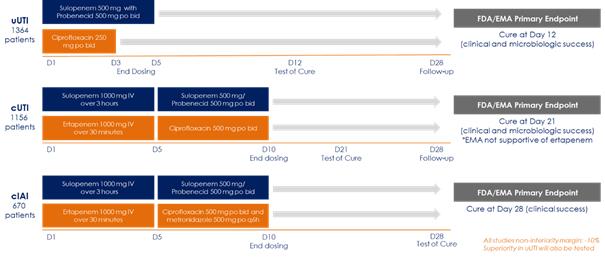

We are a pharmaceutical company dedicated to developing and commercializing sulopenem to be potentially the first and only oral and intravenous (IV) branded penem available globally. Penems, including thiopenems and carbapenems, belong to a class of antibiotics more broadly defined as ß-lactam antibiotics, the original example of which was penicillin, but which now also includes cephalosporins. Sulopenem is a potent, thiopenem antibiotic delivered intravenously which is active against bacteria that belong to the group of organisms known as gram-negatives and cause urinary tract and intra-abdominal infections. We have also successfully developed sulopenem in an oral tablet formulation, sulopenem etzadroxil-probenecid. Both sulopenem product candidates have the potential to be important new treatment alternatives to address growing concerns related to antibacterial resistance without the known toxicities of some of the most widely used antibiotics, specifically fluoroquinolones. We see two distinct opportunities for our sulopenem program: patients at elevated risk for treatment failure in the community setting suffering from uncomplicated urinary tract infections (uUTI) and hospitalized patients suffering from complicated, antibiotic-resistant infections. During the third quarter of 2018, we initiated all three clinical trials in our Phase 3 development program, which includes: a Phase 3 uncomplicated urinary tract infections, or uUTI, clinical trial, known as SUlopenem for Resistant Enterobacteriaceae (SURE) 1, comparing oral sulopenem to oral ciprofloxacin in women with uUTI, a Phase 3 complicated urinary tract infections, or cUTI, clinical trial known as SURE 2, comparing IV sulopenem followed by oral sulopenem to IV ertapenem followed by oral ciprofloxacin in adults with cUTI, and a Phase 3 complicated intra-abdominal infections, or cIAI, clinical trial known as SURE 3, comparing IV sulopenem followed by oral sulopenem to IV ertapenem followed by a combination of oral ciprofloxacin and oral metronidazole in adults with cIAI. We designed one Phase 3 clinical trial in each indication based on our end of Phase 2 meeting with the U.S. Food and Drug Administration (FDA) and feedback from the European Medicines Agency (EMA). We are conducting these three Phase 3 clinical trials under Special Protocol Assessment (SPA) agreements from the FDA. We expect to complete enrollment and produce top-line data for all three clinical trials in the second half of 2019, and to submit our new drug applications (NDAs) to the FDA by the end of 2019.

In November 2015, we acquired an exclusive, worldwide license under certain patents and know-how to develop and commercialize sulopenem and its oral prodrug, sulopenem etzadroxil, from Pfizer Inc. (Pfizer). Pfizer conducted Phase 1 and Phase 2 clinical trials of sulopenem delivered intravenously in Japan in over 1,450 patients with a variety of hospital and community acquired infections. These clinical trials documented a treatment effect in the indications studied and provided preliminary insights into the safety profile for sulopenem, which will continue to be assessed with additional clinical trials. Pfizer subsequently developed sulopenem into a prodrug formulation, sulopenem etzadroxil, to enable oral delivery. Once this prodrug is absorbed in the gastrointestinal tract, the etzadroxil ester is immediately cleaved off and the active moiety, sulopenem, is released into the bloodstream. We have further enhanced this prodrug formulation with the addition of probenecid to extend sulopenem’s half-life and enhance its antibacterial potential. Probenecid is a pharmacokinetic enhancer that has been safely and extensively used globally for decades. The oral dose of sulopenem etzadroxil-probenecid has been combined in a single bilayer tablet, which we refer to as oral sulopenem. We refer to sulopenem delivered intravenously as sulopenem and, together with oral sulopenem, as our sulopenem program.

The treatment of urinary tract and intra-abdominal infections has become more challenging because of the development of resistance by pathogens responsible for these diseases. There are approximately 13.5 million emergency room and office visits for symptoms of urinary tract infections (UTIs) and approximately 21 million uUTIs in the United States annually. Based on market research, physicians estimated that approximately 35% of these patients are at elevated risk for treatment failure. Proper antibiotic treatment of drug-resistant infections in this group is particularly important due to the risks associated with treatment failure. Elevated risk patients were defined in the research as patients with recurrent UTIs, elderly patients, patients who have a suspected or confirmed drug-resistant infection, patients with comorbidities (e.g., Diabetes mellitus) or that are immunocompromised, patients that have had a recent hospitalization, patients with a history of prior antibiotic failure and patients in a long-term care setting. Treatment failures pose significant clinical and economic challenges to the healthcare system. There are also approximately 3.6 million patients with cUTI and approximately 350,000 patients with cIAI that require antibiotic therapy every year in the United States.

Growing antibiotic resistance to E. coli, the primary cause of UTIs, has complicated the choice of treatment alternatives in both the community and hospital settings, reducing effective treatment choices for physicians. In addition, the Infectious Diseases Society of America and European Society for Microbiology and Infectious Diseases recommend against empiric use, or prescribing without results from a bacterial culture, of fluoroquinolones for uUTIs in their 2010 Update to the International Clinical Practice Guidelines for the Treatment of Acute Uncomplicated Cystitis and Pyelonephritis in Women. Similarly, the FDA in its November 2015 Advisory Committee meeting stated that the risk of serious side effects caused by fluoroquinolones generally outweighs the benefits for patients with uUTIs and other uncomplicated infections. Subsequently, the FDA mandated labeling modifications for fluoroquinolone antibiotics directing healthcare professionals to reserve fluoroquinolones for patients with no other treatment alternatives. In December 2018 the FDA further warned that fluoroquinolone antibiotics could cause aortic aneurysm and dissection in certain

1

patients, especially older persons. In October 2018, the EMA’s pharmacovigilance risk assessment committee recommended restrictions on the use of broad-spectrum antibiotics, fluoroquinolones and quinolones, following a review of side effects that were reported to be “disabling and potentially long-lasting.” The committee further stated that fluoroquinolones and quinolones should only be used to treat infections where an antibiotic is essential, and others cannot be used.

None of the most commonly used oral antibiotics for treatment of uUTIs were initially approved by the FDA within the last two decades. We believe oral sulopenem will be an important empiric treatment option for elevated risk uUTI patients because of its potency against resistant pathogens, as well as its spectrum of antibacterial activity. In addition, oral sulopenem will allow patients who develop an infection with a resistant pathogen but are stable enough to be treated in the community, to avoid the need for an IV catheter and even hospitalization. The primary endpoint of our uUTI Phase 3 clinical trial is designed to demonstrate non-inferiority in patients with ciprofloxacin-susceptible pathogens but also provides an opportunity to demonstrate superiority to ciprofloxacin for oral sulopenem in patients with ciprofloxacin-resistant pathogens.

In the hospital setting, the lack of effective oral stepdown options results in the potential for lengthy hospital stays or insertion of a peripherally inserted central catheter (PICC) to facilitate administration of IV antibiotics, even for some patients with relatively straightforward infections. Our sulopenem program may enable faster discharges, providing cost-saving advantages for the hospital and mitigating the risk of catheter-related infection for patients. Based on potency, safety and formulation advantages, we believe our sulopenem program is uniquely positioned to address unmet medical needs for patients suffering from uncomplicated and complicated infections in both the community and hospital settings.

If the FDA approves oral sulopenem and sulopenem, we plan to seek a commercial partner and/or build a commercial infrastructure to launch both product candidates in the United States. Data from a study we commissioned in 2017 to quantify quinolone resistance by zip code, in addition to data from our clinical trials and available prescriber data, will inform our initial targeted sales force as to where the medical need for a new, effective therapy for UTIs is highest in the community and hospital settings. Outside of the United States, we are evaluating our options to maximize the value of our sulopenem program.

We expect to register two suppliers and validate at least one supplier for the manufacture of the active pharmaceutical ingredient (API) at the time of our planned regulatory filings in the United States by the end of 2019. We will initially rely on a single third-party facility to manufacture all of our sulopenem tablets. In the future, given the importance of oral sulopenem to our potential commercial results, we will consider establishing additional sources.

Sulopenem etzadroxil has an issued composition of matter patent in the United States (which we have exclusively licensed from Pfizer) that is scheduled to expire in 2029, subject to potential extension to 2034 under the Drug Price Competition and Patent Term Restoration Act of 1984, hereinafter referred to as the Hatch-Waxman Act. In addition, the FDA has designated sulopenem and oral sulopenem as Qualified Infectious Disease Products (QIDP) for the indications of uUTI, cUTI, cIAI, community-acquired bacterial pneumonia, acute bacterial prostatitis, gonococcal urethritis, and pelvic inflammatory disease pursuant to the Generating Antibiotic Incentives Now Act (the GAIN Act). Fast track designation for these seven indications in both the oral and intravenous formulations has also been granted. QIDP status makes sulopenem and oral sulopenem eligible to benefit from certain incentives for the development of new antibiotics provided under the GAIN Act. Further, QIDP status could add five years to any regulatory exclusivity period that we may be granted. QIDP status for other indications is also possible given the coverage of gram-negative and gram-positive bacteria by sulopenem, pending submission of additional documentation and acceptance by the FDA. None of our licensed patents cover the IV formulation of sulopenem. Fast track status provides an opportunity for more frequent meetings with the FDA, more frequent written communication related to the clinical trials, eligibility for accelerated approval and priority review and the potential for a rolling review.

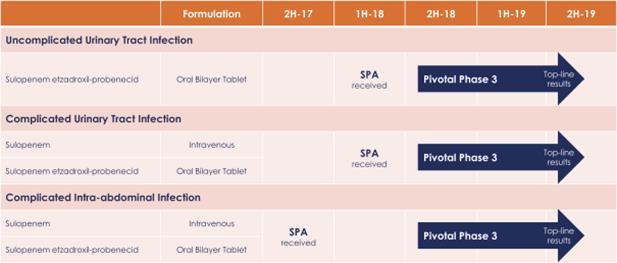

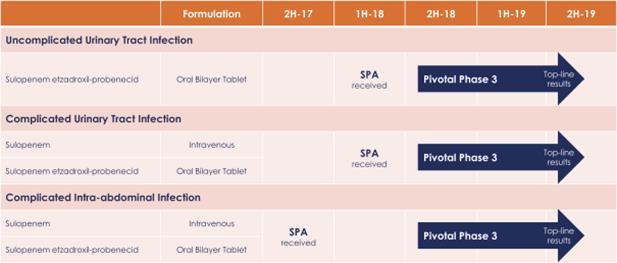

Sulopenem Program, Clinical and Regulatory Status

We plan to pursue three initial indications for oral sulopenem and sulopenem, as summarized in the chart below. We designed these Phase 3 clinical trials based on extensive in vitro microbiologic surveillance data, Phase 1 pharmacokinetic data from healthy volunteers as well as population pharmacokinetic data from patients, animal models in relevant disease settings, Phase 2 data from a program performed with sulopenem by Pfizer in Japan in the early 1990s, and regulatory feedback from the FDA at our end-of-Phase 2 meeting, all supported by an advanced commercial manufacturing program which will provide clinical supplies.

In the third quarter of 2018 we initiated all three Phase 3 clinical trials, which are being conducted under SPA agreements from the FDA. We expect to complete enrollment and produce top-line data for all three clinical trials in the second half of 2019 and submit our NDAs to the FDA by the end of 2019.

2

Our Strategy

Our strategy is to develop and commercialize our sulopenem program for multiple indications, and in the long term to build a market-leading anti-infective business. The key elements of this strategy include the following:

|

|

• |

Complete sulopenem clinical development in three initial indications. Conduct single Phase 3 clinical trials in each of our three initial indications: uUTI, cUTI and cIAI. All three clinical trials were initiated in the third quarter of 2018, and we expect to conclude enrollment in the second half of 2019, with top-line data available in the same period. Each of these trials is being conducted under a SPA agreement with the FDA. |

|

|

• |

Obtain regulatory approval for oral sulopenem and sulopenem in the United States and subsequently in the European Union. We designed our Phase 3 clinical program based on extensive discussions with the FDA, including our end-of-Phase 2 meeting in July 2017, and considered scientific advice received from the EMA to meet the regulatory filing requirements in the European Union. If our Phase 3 clinical trials are successful, we plan to submit NDAs for both oral sulopenem and sulopenem to the FDA by the end of 2019 and subsequently submit an MAA to the EMA. |

|

|

• |

Maximize commercial potential of our sulopenem program. If approved, we intend to seek a commercial partner and/or directly commercialize our sulopenem program in the United States with a targeted sales force across the community and hospital settings. Outside of the United States, we are evaluating our options to maximize the value of our sulopenem program. |

|

|

• |

Pursue the development of oral sulopenem and sulopenem in additional indications. In the future, we may pursue development of our sulopenem program in additional indications in adults and children, including community acquired bacterial pneumonia, bacterial prostatitis, diabetic foot infection and bone and joint infection, as well as new formulations to support these indications. |

|

|

• |

Build a portfolio of differentiated anti-infective products. We intend to enhance our product pipeline through strategically in-licensing or acquiring clinical stage product candidates or approved products for the community and/or hospital and acute care markets. We believe that our focus on acute care in both the community and hospital markets will make us an attractive partner for companies seeking to out-license products or product candidates in our areas of focus. |

The Medical Need

Urinary Tract and Intra-Abdominal Infections

UTIs are among the most common bacterial infections encountered in the ambulatory setting. A UTI occurs when one or more parts of the urinary system (kidneys, ureters, bladder or urethra) become infected with a pathogen (most frequently, bacteria). While many UTIs are not considered life-threatening, if the infection reaches the kidneys, serious illness, and even death, can occur. UTI diagnoses are stratified between either complicated or uncomplicated infections. uUTI refers to the invasion of a structurally and functionally normal urinary tract by a nonresident infectious organism (e.g., acute cystitis), and is diagnosed and commonly treated in an outpatient setting with an oral agent. Conversely, cUTIs, including acute pyelonephritis, are defined as a UTI ascending from the bladder accompanied by local and systemic signs and symptoms, including fever, chills, malaise, flank pain, back pain, and/or costo-

3

vertebral angle pain or tenderness, that occur in the presence of a functional or anatomical abnormality of the urinary tract or in the presence of catheterization, with treatment typically initiated by IV therapy in a hospital setting.

cIAIs have similar challenges to those of cUTIs. These complicated infections extend from a gastrointestinal source, such as the appendix or the colon, into the peritoneal space and can be associated with abscess formation.

Antimicrobial Resistance is Increasing

E. coli is growing increasingly resistant to many classes of antibiotics, which is especially problematic for patients suffering from UTIs because E. coli is the primary cause of those infections. The market-leading antibiotics, fluoroquinolones (e.g., Cipro, Levaquin) and trimethoprim-sulfamethoxazole (e.g., Bactrim, Septra), currently have E. coli resistance rates over 20% nationally. In 2015, approximately 75% of oral prescriptions for UTIs written in the United States were for fluoroquinolones or trimethoprim-sulfamethoxazole. In hospitals, fluoroquinolones have greater than 30% resistance to E. coli in approximately half the states in the United States, and have greater than 25% resistance rates in nearly 80% of the states. Between 2000 and 2009 the prevalence of extended spectrum ß-lactamases (ESBL)-producing E. coli and ESBL-producing K. pneumoniae more than doubled from 3.3% to 8.0% and from 9.1% to 18.6%, respectively. During the same timeframe, hospitalizations caused by ESBL-producing organisms increased by about 300%. The national resistance rate of E. coli to cephalosporins was estimated to be approximately 13% for the combined years of 2011 to 2015.

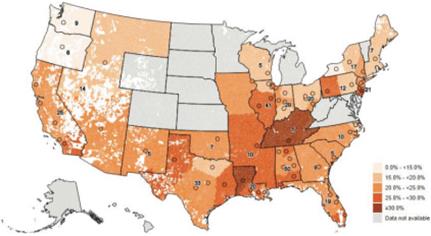

We have further delineated the prevalence of bacterial resistance to antibiotics used to treat UTIs in the United States. Based on urine culture results obtained at the zip code level from outpatient UTIs, we concluded that the prevalence of resistance of Enterobacteriaceae to quinolone antibiotics is over 20% in a significant portion of the country. In addition, in 2015, 25 states identified as high prevalence for E. coli resistance produced approximately 75% of all UTI prescriptions in the United States.

Geographic prevalence of quinolone non-susceptible Enterobacteriaceae by zip code in outpatient

urine cultures.

Numbers represent hospital centers from which data were derived

As antibiotic resistance leads to increased costs of treatment and increased morbidity, as well as increased mortality, there is an urgent unmet medical need for antimicrobial agents that can be utilized in community and hospital infections. The antimicrobial class of penems has the potential to address many of the relevant resistance issues associated with ß-lactam antibiotics because of a targeted spectrum of antibacterial activity and intrinsic stability against hydrolytic attack by many ß-lactamases, including ESBL and AmpC enzymes.

There is a Significant Population at Risk

There are approximately 13.5 million emergency room and office visits for symptoms of UTIs and approximately 21 million uUTIs in the United States annually. Based on market research, physicians estimated that approximately 35% of these patients are at elevated risk for treatment failure. Proper antibiotic treatment of drug-resistant infections in this group is particularly important due to the consequences associated with treatment failure. Elevated risk patients were defined in the research as patients with recurrent UTIs,

4

elderly patients, patients who have a suspected or confirmed drug-resistant infection, patients with comorbidities (e.g., Diabetes mellitus) or that are immunocompromised, patients that have had a recent hospitalization, patients with a history of prior antibiotic failure and patients in a long-term care setting.

There are also approximately 3.6 million patients with cUTI and approximately 350,000 patients with cIAI that require antibiotic therapy every year in the United States.

Limited Treatment Options

In addition to worsening antibiotic resistance, many of the antibiotics currently used for first-line empiric oral treatment of uUTIs, such as nitrofurantoin and trimethoprim-sulfamethoxazole, suffer from significant safety and tolerability concerns. Pulmonary fibrosis and diffuse interstitial pneumonitis has been observed in patients treated with nitrofurantoin, which is contraindicated in pregnant women after 38 weeks of gestation and newborn children due to hemolytic anemia and in patients with poor renal function. Trimethoprim-sulfamethoxazole is associated with fatal hypersensitivity reactions, embryofetal toxicity, hyperkalemia, gastrointestinal disturbances and rashes, including rare cases of Stevens-Johnson Syndrome. In addition, some antibiotics, such as nitrofurantoin and fosfomycin, have poor tissue penetration. While fluoroquinolones are now the most widely used antibiotic class in treating community and hospital gram-negative infections, the Infectious Diseases Society of America and the European Society for Microbiology and Infectious Diseases now recommend against empiric use of fluoroquinolones for uUTIs in their 2010 Update to the International Clinical Practice Guidelines for the Treatment of Acute Uncomplicated Cystitis and Pyelonephritis in Women as they “have a propensity for collateral damage and should be reserved for important uses other than acute cystitis and thus should be considered alternative antimicrobials for acute cystitis.” Similarly, the FDA in its November 2015 Advisory Committee meeting stated that the risk of serious side effects caused by fluoroquinolones generally outweighs the benefits for patients with uUTIs and other uncomplicated infections. Serious side effects associated with fluoroquinolones include tendon rupture, tendinitis, and worsening symptoms of myasthenia gravis and peripheral neuropathy. Subsequently, the FDA mandated labeling modifications for fluoroquinolones antibiotics directing healthcare professionals to reserve fluoroquinolones for patients with no other treatment alternatives. In December 2018 the FDA further warned that fluoroquinolone antibiotics could cause aortic aneurysm and dissection in certain patients, especially older persons. In October 2018 the EMA’s pharmacovigilance risk assessment committee recommended restrictions on the use of broad-specturm antibiotics, fluoroquinolones and quinolones, following a review of side effects that were reported to be “disabling and potentially long-lasting”. The committee further stated that fluoroquinolones and quinolones should only be used to treat infections where an antibiotic is essential, and others cannot be used.

The limited oral antibiotic treatment options for patients with uUTIs can sometimes result in hospitalization to facilitate administration of IV antibiotics for patients whose infection progresses; In addition, some patients whose uUTI remains uncomplicated may require hospital admission for IV therapy. For patients with cUTIs, the lack of effective oral stepdown options, and the paucity of new treatment options, which is demonstrated by the fact that none of the most commonly used oral agents were initially approved by the FDA in the last two decades, results in the potential for lengthy hospital stays or insertion of a PICC to facilitate administration of IV antibiotics, even for some patients with relatively straightforward infections. Therefore, based both on the epidemiology described above and recent discussions with practicing clinicians and pharmacists, we believe there is a pressing need for a novel oral antibacterial therapy for UTI, both complicated and uncomplicated, that has potent activity against ESBL producing and quinolone resistant gram-negative organisms.

The Challenge of Developing Antibiotics

Antibiotics work by targeting a critical function of the bacteria and rendering it non-functional. These critical functions include the ability to make proteins, to replicate further, and to build protective envelopes against the harsh external environment. These functions are coded in the bacteria’s DNA, which is copied over to each generation. Occasionally errors are made in the copying; typically, these errors kill off the progeny but can sometimes actually help them survive under specific circumstances, namely when threatened by an antibiotic.

Bacterial mutations, these changes in DNA coding, allow the organism to adapt their protein structures so as to prevent target-specific antibiotics from working. Over time, subsequent generations of bacteria retain these mutations and even develop additional mutations making them resistant to multiple classes of antibiotics and generating what is known as multi-drug resistant (MDR) pathogens. Furthermore, bacteria have also developed mechanisms that allow them to pass these genetic mutations directly to other nearby bacteria, even those from a different species. As there are a limited number of antibiotic classes available today, there is a concern that eventually we will not have any antibiotics to treat patients who develop an infection caused by these MDR bacteria. We continue to need new antibiotics that stay one step ahead of these mutating bacteria in order to protect against the infections that they cause.

5

The Solution to Rising Resistance

The solution to the problem of resistance is based on strategies to use those antibiotics only when patients really need them, limiting the number of opportunities for the bacteria to develop these mutations, and to continue efforts aimed at the discovery and development of new and effective antibacterial agents.

These new agents will need to:

|

|

• |

kill the organisms responsible for the actual infection; |

|

|

• |

target a specific bacterial function and overcome the existing resistance mechanisms around that function; |

|

|

• |

be powerful enough to require a minimal amount of drug to kill the organism at the site of infection; and |

|

|

• |

be delivered to a patient in a manner which is safe, tolerable and convenient. |

For the last thirty years, the penem class of antibiotics, including carbapenems such as imipenem, meropenem, doripenem and ertapenem, have been potent and reliable therapeutic options for patients with serious infections. Their spectrum of activity includes those pathogens responsible for infections such as those in the intra-abdominal space, urinary tract, and respiratory tract with a potency as good or better than any other antibiotic class, targeting the cell wall of bacteria, a critical element of bacterial defense. Resistance to the class, generally caused by organisms which have acquired a carbapenemase, is rarely, if ever, seen in the community setting and is primarily localized to patients with substantial healthcare exposures, particularly recent hospitalizations. These drugs are generally very well tolerated. Their limitation is the requirement to be delivered intravenously, restricting their utility to hospitalized patients.

Our Sulopenem Program

Our sulopenem program has the potential to offer a solution to the problem of antibiotic resistance and the limitations of existing agents. Sulopenem has in vitro activity against gram-negative organisms with resistance to one or more established antibiotics and can be delivered in an oral formulation. If a UTI occurs in the community setting, oral sulopenem can be provided as a tablet, offering an option for care of those with a culture proven or suspected MDR pathogen, potentially avoiding the need for hospitalization. If a patient requires hospitalization for an infection due to a resistant organism, treatment can be initiated intravenously with sulopenem and once the infection begins to improve, stepped down to oral sulopenem, potentially enabling the patient to leave the hospital.

Potential Advantages of Oral Sulopenem and Sulopenem

We are developing our sulopenem program to offer patients and clinical care providers a new option to treat drug-resistant gram-negative infections with confidence in its antimicrobial activity, and the flexibility to treat patients in the community while getting those hospitalized back home.

Sulopenem’s differentiating characteristics include:

|

|

• |

Activity as an oral agent and favorable pharmacokinetic profile. Sulopenem is the active moiety with antibacterial activity. Oral sulopenem is a prodrug specifically selected among many other prodrug candidates because it enables the absorption of sulopenem from the gastrointestinal tract. It is this oral agent, sulopenem etzadroxil, combined with probenecid that we believe meets an urgent medical need to allow patients with resistant pathogens to be treated safely in the community, as well as allowing hospitalized patients to continue their treatment at home. Oral sulopenem is sufficiently absorbed from the gastrointestinal tract to allow the parent compound, sulopenem, to achieve adequate exposure in the tissues and, as demonstrated in animal models, to significantly reduce the burden of offending pathogens. Based on pharmacokinetic modeling and supported by prior clinical data from Japan, we believe dosing of the oral agent twice daily will provide tissue exposure sufficient to resolve clinical infection. |

|

|

• |

Targeted spectrum of activity against relevant pathogens without pressure on other incidental gram-negative organisms. Sulopenem is active against the pathogens that are most likely to cause infection of the urinary and gastrointestinal tract, including E. coli, K. pneumoniae, P. mirabilis and B. fragilis. Like ertapenem, sulopenem is not active against certain gram-negative organisms such as Pseudomonas aeruginosa and Acinetobacter baumannii. These organisms are not typically seen in community UTIs and are infrequently identified in UTIs in the hospital, except when patients have had an indwelling urinary catheter for an extended duration. As a result, we believe the targeted spectrum of sulopenem is less likely to put pressure on those pathogens which could otherwise have led to carbapenem resistance. |

6

|

|

empiric therapy before culture results become available. Sulopenem is active against organisms that have multiple resistance mechanisms and can help avoid some of the consequences of ineffective antibiotic therapy. |

|

|

• |

Documented safety and tolerability profile. Adverse event data collected as part of the Japanese Phase 2 development program conducted by Pfizer with the IV formulation provided preliminary insights into the safety profile for sulopenem, which will continue to be assessed with additional clinical trials. Data is also available for the oral formulation collected in healthy volunteers in the Phase 1 program conducted by us that is consistent with a well-tolerated regimen and similar to the adverse event profile observed with the IV formulation. One additional adverse event identified with the oral prodrug is loose stools, which were considered of mild severity and were self-limited, as seen with other broad spectrum oral antibiotics with activity against the anaerobic flora of the gastrointestinal tract. In the Japanese program, one patient reported a serious adverse event related to sulopenem of a transient elevation in liver function tests. The patient died due to metastatic lung cancer. Other serious adverse events recorded in patients receiving sulopenem in the Japanese program, which were not related by the investigator to sulopenem, included myocardial infarction with respiratory failure and progression of underlying ovarian carcinoma, in both cases resulting in death. For each of these patients, sulopenem was not determined to be the cause of death. |

|

|

• |

Availability of an IV formulation. Sulopenem is expected to be available intravenously. Patients sick enough to require hospitalization may not be good candidates for initial oral therapy given potential uncertainties around the ability to absorb drugs due to diminished gastrointestinal and target tissue perfusion in patients with compromised cardiovascular status associated with sepsis or reduced gastrointestinal motility. An IV and oral formulation will enable the conduct of clinical registration trials in a manner consistent with typical clinical practice, allow for confidence in the initiation of therapy in seriously ill patients and, if approved, offer both important formulations as therapeutic options. |

|

|

• |

Advanced manufacturing program. The synthetic pathway for sulopenem, initially defined in the 1980s, has now evolved through its third iteration, incorporating improvements in yield and scalability. We expect to register two different contract manufacturing organizations to manufacture the API for oral sulopenem and sulopenem. Both of the contract manufacturers have the capability to produce vials for IV delivery. We will initially rely on a single third-party facility to manufacture all of our sulopenem tablets. In the future, given the importance of sulopenem to our potential commercial results, we will consider establishing additional sources. |

Market Opportunity for Oral Sulopenem and Sulopenem

Based upon the clinical evidence to date in eradicating key pathogens, coupled with unmet medical needs, if approved, we expect the commercial opportunity for oral sulopenem and sulopenem to be substantial with initial focus on the following areas:

|

|

• |

treating uUTI with an oral formulation in community treatment settings; |

|

|

• |

treating cUTI with initiation of IV therapy in the hospital; |

|

|

• |

treating cUTI with an oral formulation upon discharge from hospital to complete therapy in the community setting; |

|

|

• |

treating cIAI with initiation of IV therapy in the hospital; and |

|

|

• |

treating cIAI with an oral formulation upon discharge from hospital to complete therapy in the community setting. |

Acute cystitis remains one of the most common indications for prescribing antimicrobials to otherwise healthy women, resulting in as many as 13.5 million office or emergency room visits in the United States annually, according to a review published in 2015. Up to 50% of all women experience one episode by 32 years of age. In addition, there are approximately 3.6 million patients a year in the United States for the more serious cases of cUTI.

In addition, cIAIs are the second most common cause of infectious mortality in intensive care units. Among approximately 350,000 cIAI patients in the United States each year, broad spectrum antibiotics are generally administered as first line treatment; treatment failure is more common due to the serious nature of these infections.

In the United States, E. coli resistance presently exceeds 20% for fluoroquinolones, trimethoprim-sulfamethoxazole and ampicillin. Our market research indicated that physicians identified the lack of effective oral agents for these more difficult drug-resistant infections as a key unmet need in their practice. Physicians are particularly concerned by drug-resistant infections in the 35% of patients considered to be at elevated risk for treatment failure, as they pose significant potential clinical and economic challenges to the healthcare system when initial therapy is unsuccessful.

Given the growing prevalence of bacterial resistance that has rendered existing oral therapies ineffective, coupled with the FDA mandating new safety labeling changes to enhance warnings limiting fluoroquinolone use in uncomplicated infections due to the

7

association with disabling and potentially permanent side effects, physicians are seeking new alternatives to safely and effectively treat their patients.

We believe oral sulopenem’s value proposition will aid physicians in the community setting to address the unmet need for a safe and effective oral uUTI therapy to treat the growing number of patients with suspected or confirmed resistant pathogen(s). In addition, we believe our sulopenem program will offer a compelling value proposition to hospitals by enabling the transition of patients from IV therapy in the inpatient setting to an oral therapy in the community.

Oral Sulopenem and Sulopenem Clinical Development Program

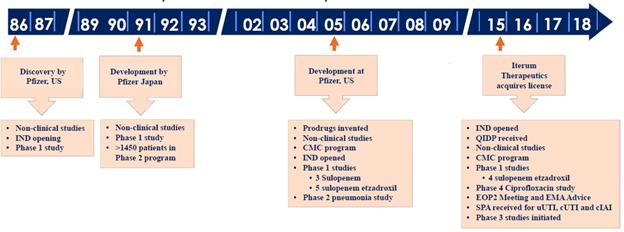

The following graphic provides an overview of the past development of sulopenem etzadroxil and sulopenem by Pfizer and Iterum.

Discovery, Development, and Regulatory History of Sulopenem and Sulopenem Etzadroxil, by year

The objective of our sulopenem program is to deliver to patients an oral and IV formulation of sulopenem approved in the United States and Europe for the treatment of infections due to resistant gram-negative pathogens. Sulopenem’s spectrum of activity, the availability of an oral agent delivered in a convenient dosing schedule and the evolving safety profile support its further development for the target indications of uUTI, cUTI and cIAI. Oral sulopenem is the oral prodrug metabolized to sulopenem, its therapeutically active form, combined with probenecid.

Both sulopenem and oral sulopenem have received QIDP designation status for the indications of uUTI, cUTI and cIAI as well as for community-acquired bacterial pneumonia, acute bacterial prostatitis, gonococcal urethritis, and pelvic inflammatory disease. Fast track designation for these seven indications in both the oral and intravenous formulations has also been granted. QIDP designation status for other indications is also possible given the coverage of gram-negative and gram-positive bacteria by sulopenem, pending submission of additional documentation and acceptance by the FDA. We have received feedback on the development program in an end of Phase 2 meeting with the FDA, which provided guidance on the size of the safety database, the nonclinical study requirements, the design of the Phase 1 and Phase 3 clinical trials, the pediatric development plan, as well as support for the proposed chemistry, manufacturing and controls (CMC) development activities through production of commercial supplies. The Phase 3 clinical trials for treatment of cIAI, cUTI and uUTI have received SPA agreements with the FDA. All three Phase 3 clinical trials were initiated in the third quarter of 2018, and we expect top-line delivery of data in the second half of 2019 and submission of our NDAs to the FDA by the end of 2019. We also have an agreement with the FDA on a pediatric study plan. Development work on pediatric formulations is ongoing, and we expect to commence Phase 1 studies in children in 2019.

Microbiology Surveillance Data

Sulopenem has demonstrated potent in vitro activity, as defined by its minimum inhibitory concentration (MIC), against nearly all genera of Enterobacteriaceae, in anaerobes such as Bacteroides, Prevotella, Porphyromonas, Fusobacterium and Peptostreptococcus, gram-positive organisms including methicillin-susceptible staphylococci, Streptococcus pyogenes and Streptococcus pneumoniae, as well as other community respiratory pathogens such as Haemophilus influenzae and Moraxella catarrhalis. The MIC is a measure used to describe the results of an in vitro assay in which a fixed number of a strain of bacteria are added to a 96-well plate and increasing concentrations of antibiotic are sequentially added to the wells. The concentration of antibiotic which inhibits growth of the bacteria in a well is considered the MIC. When looking across a collection of many strains of a species of

8

bacteria, the MIC90 is the lowest concentration of antibiotic at which 90% of the strains are inhibited. Sulopenem lacks in vitro activity (MIC90 ≥ 16 µg/mL) against the oxidative non-fermenting pathogens such as Pseudomonas aeruginosa, Acinetobacter baumanii, Burkholderia cepacia, and Stenotrophomonas maltophilia. Given its lack of potency against Pseudomonas aeruginosa, its use in treatment of infections caused by pathogenic Enterobacteriaceae should not select for pseudomonas resistant to carbapenems, as can occur with imipenem and meropenem. For various species of enterococci, the MIC90 values were 4 to ≥ 64 µg/mL. Methicillin-resistant staphylococci also have high MIC values.

The table below highlights the MIC50 and MIC90 of key target pathogens collected by International Health Management Associates (IHMA) between 2013 and 2015 responsible for the infections that will be studied in our Phase 3 program.

|

Organism Class

|

N

|

|

MIC50

|

|

MIC90

|

|

E. coli |

189 |

|

0.015 |

|

0.03 |

|

ESBL negative |

169 |

|

0.015 |

|

0.03 |

|

ESBL positive |

20 |

|

0.03 |

|

0.06 |

|

Klebsiella spp. |

124 |

|

0.03 |

|

0.06 |

|

ESBL negative |

108 |

|

0.03 |

|

0.06 |

|

ESBL positive |

16 |

|

0.03 |

|

0.25 |

|

P. mirabilis |

14 |

|

0.12 |

|

0.25 |

|

E. aerogenes |

57 |

|

0.06 |

|

0.25 |

|

C. koseri |

60 |

|

0.03 |

|

0.03 |

|

S. marcescens |

55 |

|

0.12 |

|

0.50 |

|

Gram-negative anaerobes |

125 |

|

0.12 |

|

0.25 |

|

Staphylococcus saprophyticus |

31 |

|

0.25 |

|

0.25 |

A comparison of the in vitro activity of sulopenem relative to other carbapenems, as well as to currently prescribed oral agents for UTI, is provided below. The activity of sulopenem at slightly higher doses was very similar to that of ertapenem and meropenem, which are currently commercially available. In addition, sulopenem is noted to have potent in vitro activity against relevant organisms that are resistant to fluoroquinolones and trimethoprim-sulfamethoxazole and are ESBL positive. The prevalence of resistance for the existing generic antibiotics, now exceeding 20% for many pathogens, underscores the challenge of treating patients with uUTI in an outpatient setting or releasing patients from the hospital with a cUTI or cIAI on a reliable stepdown oral therapy.

|

|

E. coli

|

K. pneumoniae

|

P. mirabilis

|

|||

|

Penem Class:

|

MIC90

|

% S

|

MIC90

|

% S

|

MIC90

|

% S

|

|

Sulopenem |

0.06 |

* |

0.12 |

* |

0.25 |

* |

|

Ertapenem |

0.015 |

100 |

0.12 |

97 |

0.03 |

100 |

|

Meropenem |

0.03 |

100 |

0.06 |

97 |

0.12 |

100 |

|

|

|

|

|

|

|

|

|

Oral Agents Currently on Market: |

|

|

|

|

|

|

|

Nitrofurantoin |

16 |

97 |

≥64 |

23 |

≥64 |

0 |

|

Fosfomycin |

8 |

98 |

128 |

86 |

64 |

95 |

|

Ciprofloxacin |

≥2 |

77 |

1 |

91 |

≥2 |

74 |

|

Trimethoprim-Sulfamethoxazole |

≥32 |

74 |

≥32 |

86 |

≥32 |

58 |

|

Amoxicillin-Clavulanate |

16 |

76 |

≥16 |

80 |

≥16 |

74 |

N = bacterial samples; each product candidate was tested using the same sample size

|

|

% S = |

percentage susceptible, meaning the proportion of the number of isolates tested that had a MIC below the FDA defined |

|

|

* |

Susceptibility breakpoints are established by the FDA and documented in product labeling based on the antibacterial agent |

Animal Models

Sulopenem reduced the bacterial burden in the bladder and tissues of infected animals in a uUTI model in both diabetic and normal C3H/HeN mice using a MDR ST131 E. coli, a strain which is ESBL positive and resistant to fluoroquinolones and

9

trimethoprim-sulfamethoxazole. Sulopenem was highly efficacious and remarkably robust in its reduction in bacterial burden, leading to complete resolution of bacteriuria in all or most of the animals in both study arms with the high dose treatment regimen also reducing bacterial burden in bladder tissue and the kidney.

Non-clinical Pharmacology

Metabolic clearance is primarily characterized by hydrolysis of the ß-lactam ring. Sulopenem does not inhibit the major cytochrome P450 isoforms suggesting a low potential for drug interactions at therapeutic concentrations. It is predominantly excreted in the urine. Plasma protein binding for sulopenem is low at approximately 11%.

Phase 1 Program

The table below outlines the Phase 1 clinical trials that have been conducted with sulopenem etzadroxil and sulopenem.

|

Protocol

|

Year

|

Dose (mg), other medication

|

Subjects on sulopenem or sulopenem etzadroxil

|

Treatment (Days)

|

|

Sulopenem (CP-70,429)—Phase 1 Single Dose Clinical Trials |

||||

|

A109001 |

1987 |

1000 mg |

6 |

1 |

|

Japanese PK |

|

250 mg, 500 mg, 1000 mg |

18 |

1 |

|

A7371007 |

2007 |

400 mg, 800 mg, 1600 mg, 2400 mg, 2800 mg, placebo |

24 |

1 |

|

IT001-105 (1) |

2018 |

366 mg IV, 1000 mg IV |

46 |

1 |

|

Sulopenem (CP-70,429)—Phase 1 Multiple Dose Clinical Trials |

||||

|

Japanese PK |

|

500 mg, 1000 mg |

12 |

5 |

|

Japanese PK |

|

1000 mg |

6 |

5 |

|

A1091001 |

2009 |

800 mg, 1200 mg, 1600 mg, 2000 mg, placebo |

40 |

14 |

|

Sulopenem etzadroxil (PF-03709270)—Phase 1 Single Dose Clinical Trials |

||||

|

A8811001 |

2007 |

400 mg, 600 mg, 1000 mg, 2000 mg, placebo |

9 |

1 |

|

A8811006 |

2008 |

2000 mg |

4 |

1 |

|

A8811007 |

2007 |

600 mg, probenecid |

4 |

1 |

|

A8811008 |

2008 |

1200 mg, probenecid |

24 |

1 |

|

A8811018 |

2008 |

1000 mg, 1200 mg, probenecid, aluminum hydroxide, pantoprazole |

17 |

1 |

|

A8811003 |

2008 |

2000 mg, 4000 mg, 6000 mg, 8000 mg, placebo |

11 |

1 |

|

IT001-101 |

2017 |

500 mg, 1000 mg, probenecid |

48 |

1 |

|

IT001-102(1) |

2017 |

500 mg, probenecid |

13 |

1 |

|

IT001-105 (1) |

2018 |

500 mg, probenecid, bilayer tablet |

36 |

1 |

|

Sulopenem etzadroxil (PF-03709270)—Phase 1 Multiple Dose Clinical Trials |

||||

|

A8811003 |

2008 |

2000 mg, 1200 mg, probenecid, placebo |

18 |

10 |

|

A8811015 |

2009 |

500 mg, 1000 mg, 1500 mg, probenecid, placebo, Augmentin |

48 |

7 |

|

IT001-101 |

2017 |

500 mg, probenecid |

64 |

7 |

|

Sulopenem (CP-70,429), Sulopenem etzadroxil (PF-03709270)—Phase 1 Renal Impairment Clinical Trial |

||||

|

A8811009 |

2010 |

200mg, 800 mg sulopenem or 1000 mg sulopenem etzadroxil |

29 |

1 |

|

|

|

|

|

|

|

|

|

Total |

306 |

|

|

|

(1) |

Final report pending. |

Oral Sulopenem

We have designed oral sulopenem to include probenecid, a pharmacokinetic enhancer that delays the excretion through the kidneys of sulopenem and other ß-lactam antibiotics and has been extensively used for this purpose and the treatment of gout. It enables us to maximize the antibacterial potential of any given dose of oral sulopenem.

We conducted three Phase 1 clinical trials, IT001-101, IT001-102 and IT001-105, in healthy volunteers, in part to select the prodrug and explore various doses of probenecid combined with 500 mg of sulopenem etzadroxil. Findings from these clinical trials are consistent with those from other pharmacokinetic studies that employed different total doses of sulopenem etzadroxil. Specifically, the AUC (area under the curve, a measure of total exposure) and Cmax (maximum plasma concentration) are generally dose-proportional, and the concomitant use of probenecid increases the plasma exposure of sulopenem with any dose with which it was studied.

10

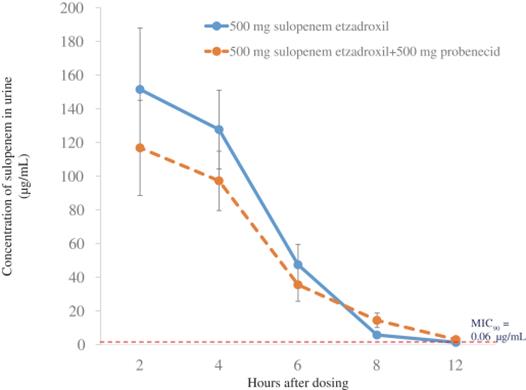

The mean total sulopenem exposures in the urine after a single 500 mg dose in IT001-101 exceeded the MIC90 for the entire twice-daily dosing interval in the 32 healthy volunteers who received 500 mg of sulopenem etzadroxil, as illustrated in the graph below. In a urine antibacterial assay, urine collected at two hours post-dose was bactericidal for numerous strains of E. coli and K. pneumoniae, including a strain of K. pneumoniae that was resistant to meropenem and imipenem, with a sulopenem MIC of 16 µg/mL.

Mean total sulopenem exposure in urine after single 500 mg dose of sulopenem etzadroxil with or without probenecid

In IT001-102, we evaluated sulopenem etzadroxil administered with and without probenecid in a randomized cross-over trial in healthy volunteers in a fasted state. Subjects receiving sulopenem etzadroxil co-administered with probenecid demonstrated an increase in the time over MIC (of a 12 hour dosing interval) and AUC of sulopenem, as shown in the table below.

|

|

|

|

|

|

Sulopenem Parameter (Day 1) |

||||||

|

Treatment |

N |

|

Descriptive |

|

Cmax

|

|

AUC0-¥

|

|

T>MIC

|

|

T>MIC

|

|

500 mg Sulopenem etzadroxil |

10 |

|

Mean |

|

1928 |

|

3871 |

|

2.8 |

|

23.3 |

|

500 mg Sulopenem etzadroxil + 500 mg probenecid |

11 |

|

Mean |

|

1929 |

|

4964 |

|

3.6 |

|

30.2 |

N = number of subjects; Cmax = maximum plasma concentration; AUC0-¥ = area under the curve from the initiation of dosing extrapolated

through infinite time

In addition, results from IT001-101 demonstrated that food increases the mean AUC and mean time over MIC (0.5 µg/mL) of 500 mg sulopenem etzadroxil dosed with 500 mg probenecid on Day 1 by 62% and 68%, respectively.

11

A Phase 1 drug interaction study with itraconazole is underway and we plan to conduct an additional drug interaction study with valproic acid to support our NDAs. Other Phase 1 clinical trials may be added as the needs of the program dictate.

Sulopenem, IV Formulation

Doses of sulopenem up to 2800 mg as a single IV dose and 2000 mg BID, or twice daily, of sulopenem as IV over fourteen days were studied in three Phase 1 clinical trials in healthy adults, one study in patients with renal insufficiency in the United States and two Phase 1 clinical trials in Japan. Results from these pharmacokinetic studies with various IV doses of sulopenem delivered over various durations established dose proportionality among the regimens with regard to AUC and maximal plasma concentrations (Cmax). A representative analysis of pharmacokinetic parameters, a subset of study A1091001, is described in the table below.

|

N

|

|

Dose

|

|

Infusion duration (h) |

Cmax

|

|

AUC 0-¥

|

|

T1/2

|

|

CLtotal

|

||

|

Day 1 |

8 |

|

800 |

|

3 |

|

7.27 |

|

22.4 |

|

0.83 |

|

|

|

|

8 |

|

1200 |

|

1 |

|

32.5 |

|

42.3 |

|

1.04 |

|

|

|

|

8 |

|

1200 |

|

2.5 |

|

16.6 |

|

41.9 |

|

1.12 |

|

|

|

Day 14 |

5 |

|

800 |

|

3 |

|

8.97 |

|

26.5 |

|

0.89 |

|

15.4 |

|

|

6 |

|

1200 |

|

1 |

|

30.7 |

|

41.4 |

|

1.05 |

|

14.7 |

|

|

6 |

|

1200 |

|

2.5 |

|

13.5 |

|

34.6 |

|

1.01 |

|

18.8 |

N = number of subjects; Cmax = maximum plasma concentration; AUC0-¥ = area under the curve from the initiation of dosing extrapolated

through infinite time; T½ = half-life; CLtotal = clearance (only measured on Day 14)

Modeling and Dose Selection

Based on in vitro susceptibility data from surveillance studies, pharmacokinetics gathered from Phase 1 clinical trials, and population pharmacokinetic data from patients, we performed modeling to help choose the doses for the Phase 3 program. The MIC90 for all Enterobacteriaceae potentially involved in the target indications was 0.25 µg/mL and for the weighted distribution of pathogens most likely to be associated with the indication was 0.06 µg/mL. We have performed modeling both for the weighted distribution of MICs expected in the clinical trials as well as at a fixed MIC of 0.5 µg/mL. Data obtained from animal experiments confirmed that, similar to carbapenems and lower than that for other ß-lactams, the %Tfree >MIC required for bacteriostasis is approximately 10–19%, depending on the dosing regimen; we have used 17% in our models. Based on the outputs from those models, the IV dose of sulopenem being studied in the ongoing Phase 3 clinical trials is 1000 mg sulopenem delivered over 3 hours once a day. The oral dose being studied is 500 mg of sulopenem etzadroxil given with 500 mg of probenecid in a single bilayer tablet twice daily.

Japanese Clinical Data

Pfizer’s affiliate in Japan conducted extensive clinical development of sulopenem in over 1,450 patients in Phase 1 and Phase 2 clinical trials in Japan in patients with skin infections, respiratory tract infections, gynecologic infections, cUTI and intra-abdominal infections.

Phase 2 clinical trials conducted by Pfizer in Japan, 1991-1993

|

Study #

|

Description

|

Sulopenem Dose

|

Comparator

|

N

|

|

91-002 |

Multiple infections in: Internal medicine Surgery: includes cIAI Urology: pyelonephritis cystitis |

250 mg IV BID 500 mg IV BID |

None |

108 |

|

|

|

|

|

|

|

92-002 |

Multiple infections in: Internal medicine Surgery: includes cIAI Urology: pyelonephritis cystitis |

250 mg IV BID 500 mg IV BID |

None |

961 |

|

|

|

|

|

|

|

91-002 92-002 |

Population-Pharmacokinetics (only) |

250 mg IV BID 500 mg IV BID |

N/A |

216 |

|

|

|

|

|

|

|

93-001 |

Respiratory Tract Infection |

250 mg IV BID 500 mg IV BID |

Cefotiam IV |

75 |

|

|

|

|

|

|

12

|

Study #

|

Description

|

Sulopenem Dose

|

Comparator

|

N

|

|

cUTI |

250 mg IV BID 500 mg IV BID |

Imipenem IV |

114 |

|

|

|

|

|

|

|

|

Total |

|

|

|

1474 |

A treatment effect in small Phase 2 clinical trials was observed in a number of infections including skin infections, respiratory tract infections, gynecologic infections and, most relevant to the targeted indications being pursued in our Phase 3 program, cUTI and cIAI. The data from these clinical trials may not be directly comparable to data from clinical trials that would be conducted today or the data that we anticipate from our Phase 3 program for a variety of reasons, including that the protocols were designed for different purposes and as a consequence had different enrollment and efficacy evaluation criteria. While these data are not required for approval of our intended indications, we believe these results support our decision to develop sulopenem for our targeted indications and informed our dose selection.

In 1993, Pfizer Japan conducted 93-002, a randomized clinical trial in subjects with cUTI, comparing 250 mg twice daily and 500 mg twice daily of sulopenem administered intravenously to an intravenously-delivered imipenem-cilastatin, also given twice daily.

The trial enrolled patients who were hospitalized, with an underlying disease of the urinary tract and with evidence of pyuria, measured by ≥ 5 WBC/hpf (white blood cells per high power field, a measure of inflammation in the urinary tract) at baseline. Study therapy was administered for five days and was open-label with respect to sulopenem versus the comparator but was blinded as to the sulopenem dose. Efficacy was assessed by the investigator based on subjective and objective criteria, as shown below.

The criteria for patient enrollment in the Phase 2 clinical trial 93-002 are different than those currently established by the FDA in guidelines for Phase 3 cUTI registrational trials published in 2015. In addition to an Intent-to-Treat (ITT) analysis, which includes all randomized patients, of the investigator’s assessment of overall efficacy based on the original inclusion criteria, a post hoc analysis was also performed by Iterum of the investigator’s assessment of overall efficacy in the population of patients that met enrollment criteria consistent with current FDA guidance, such as baseline urinalysis with >10 WBC/hpf and a urine culture which grew >105 susceptible organisms, as shown below. ITT analyses are performed in the population of all randomized patients. Success, as determined by the investigator and specified in the protocol, was judged for each patient based on resolution of symptoms, pyuria and bacteriuria.

|

Investigator Assessment of Overall Efficacy |

Sulopenem

|

|

Sulopenem

|

|

Comparator

|

|

ITT |

|

|

|

|

|

|

Success |

33/36 (91.7) |

|

36/38 (94.7) |

|

32/39 (82.1) |

|

Failure |

2/36 (5.6) |

|

2/38 (5.3) |

|

2/39 (5.1) |

|

Indeterminant |

1/36 (2.8) |

|

0 |

|

5/39 (12.8) |

|

Difference vs. comparator (95% CI) |

9.6 (-6.6, 25.9) |

|

12.7 (-2.1, 28.4) |

|

|

|

Clinically Evaluable using FDA inclusion criteria (post hoc) |

|

|

|

|

|

|

Success |

19/20 (95.0) |

|

22/22 (100.0) |

|

16/16 (100.0) |

|

Failure |

1/20 (5.0) |

|

0 |

|

0 |

|

Difference vs. comparator (95% CI) |

-5.0 (-24.0, 15.3) |

|

0 (-15.2, 19.8) |

|

|

One patient received a dose other than 250 mg or 500 mg IV BID.

The results of a subset analysis that included patients from clinical trials conducted in 1991 and 1992, 91-002 and 92-002, with a diagnosis that fit the FDA’s definition of cIAIs are provided below, based on the investigator’s assessment of clinical response at the end of therapy in the ITT and clinically evaluable populations. Success, as determined by the investigator and specified in the protocol, was judged for each patient based on resolution of cIAI signs and symptoms and improvement in relevant laboratory tests.

|

Investigator Assessment of Outcome |

Sulopenem

|

|

Sulopenem

|

|

ITT |

|

|

|

|

Success |

14/15 (93.3) |

|

78/88 (88.6) |

|

Failure |

1/15 (6.7) |

|

4/88 (4.5) |

13

|

Investigator Assessment of Outcome |

Sulopenem

|

|

Sulopenem

|

|

|

|

6/88 (6.8) |

|

|

Clinically Evaluable |

|

|

|

|

Success |

14/15 (93.3) |

|

77/81 (95.1) |

|

Failure |

1/15 (6.7) |

|

4/81 (4.9) |

Three patients received a dose other than 250 mg or 500 mg IV BID.

We used the data collected in these studies to inform the design of the cUTI proposed regimens.

The results of a Phase 2 clinical trial conducted in 1993 in hospitalized patients with community acquired pneumonia (CAP), 93-001, are provided below, including the investigator’s assessment of clinical response at the end of therapy in the ITT and clinically and bacteriologically evaluable populations with the bacteriologically evaluable population meaning the clinically evaluable patients who had a baseline pathogen and follow up microbiology data to allow an assessment of bacteriological efficacy. Success, as determined by the investigator and specified in the protocol, was judged for each patient based on resolution of the signs and symptoms of pneumonia, and improvement in radiologic findings and other relevant tests.

|

Investigator Response at End of Treatment |

Sulopenem

|

|

Sulopenem

|

|

Comparator

|

|

ITT |

|

|

|

|

|

|

Success |

19/26 (73.1) |

|

17/23 (73.9) |

|

22/25 (88.0) |

|

Failure |

4/26 (15.4) |

|

3/23 (13.0) |

|

2/25 (8.0) |

|

Indeterminant |

3/26 (11.5) |

|

3/23 (13.0) |

|

1/25 (4.0) |

|

Difference vs. comparator (95% CI) |

-14.9 (-36.7, 7.7) |

|

-14.1 (-37.1, 8.8) |

|

|

|

Clinically Evaluable |

|

|

|

|

|

|

Success |

18/20 (90.0) |

|

15/17 (88.2) |

|

20/20 (100.0) |

|

Failure |

2/20 (10.0) |

|

2/17 (11.8) |

|

|

|

Difference vs. comparator (95% CI) |

-10.0 (-30.4, 7.3) |

|

-11.8 (-34.7, 5.8) |

|

|

|

Bacteriologically Evaluable |

|

|

|

|

|

|

Success |

8/8 (100.0) |

|

5/6 (83.3) |

|

9/9 (100.0) |

|

Failure |

— |

|

1/6 (16.7) |

|

— |

|

Difference vs. comparator (95% CI) |

0.0 (-33.8, 31.2) |

|

-16.7 (-57.6, 18.1) |

|

|

Phase 2 Clinical Trial with sulopenem and sulopenem etzadroxil

In 2009, Pfizer initiated a Phase 2, randomized, double-blind, double-dummy clinical trial in hospitalized patients with CAP comparing two regimens of IV sulopenem followed by sulopenem etzadroxil to ceftriaxone IV followed by amoxicillin-clavulanate. The sulopenem regimens were a single 600 mg IV dose of sulopenem followed by 1000 mg BID of sulopenem etzadroxil or a 600 mg of sulopenem for a minimum of four doses followed by 1000 mg BID of sulopenem etzadroxil. The clinical trial was terminated early for business reasons after 33 of 250 planned total patients were enrolled and treated. Clinical response rates at the test-of-cure visit (7–14 days after end of therapy) of the ITT patients were similar on each regimen (9/10, 9/11 and 7/12, on sulopenem single IV dose, sulopenem multidose IV and ceftriaxone, respectively). Treatment-emergent adverse events were reported in six subjects each in the sulopenem groups and eight subjects in the ceftriaxone group. The most common treatment-emergent adverse event was diarrhea, reported by a total of six subjects (two in each treatment group). Treatment related diarrhea was reported by one subject following sulopenem single dose IV, and by a further two subjects following ceftriaxone. There was one treatment-related serious adverse event in the ceftriaxone group. There were no deaths reported in this clinical trial.

Phase 3 Clinical Trials

Based on FDA Guidance from February 2015 (Complicated Intra-Abdominal Infections: Developing Drugs for Treatment. Guidance for Industry; Complicated Urinary Tract Infections: Developing Drugs for Treatment. Guidance for Industry) and on recently conducted studies by other sponsors, we negotiated SPA agreements for cUTI, cIAI and uUTI. All three Phase 3 clinical trials were initiated in the third quarter of 2018. Oral sulopenem alone is being studied for the treatment of outpatients with uUTI, while oral sulopenem and sulopenem are being studied for the treatment of cUTI and cIAI. A brief overview of the comparator agents, sample size, timing of efficacy assessments and duration of oral and IV dosing is provided in the graphic below. Non-inferiority in these clinical trials is defined by the lower limit of the confidence interval in the treatment difference of no more than -10%. The uUTI clinical trial will also test for superiority in the subset of patients with ciprofloxacin resistant pathogens at baseline. An open-label

14