EXHIBIT 99.1

FOR IMMEDIATE RELEASE

Iterum Therapeutics Reports Second Quarter 2022 Financial Results

--Enrollment in Registration Trial for uUTI to Begin Q4 2022--

--Cash Runway into 2024-

DUBLIN, Ireland and CHICAGO, August 12, 2022 -- Iterum Therapeutics plc (Nasdaq: ITRM) (“Iterum”), a clinical-stage pharmaceutical company focused on developing next generation oral and IV antibiotics to treat infections caused by multi-drug resistant pathogens in both community and hospital settings, today reported financial results for the second quarter ended June 30, 2022.

“We are excited to start our planned Phase 3 clinical trial in uncomplicated urinary tract infections (“uUTI”) in the coming months,” said Corey Fishman, Chief Executive Officer. “As previously announced, we reached an agreement with the U.S. Food and Drug Administration (“FDA”) on the key elements of the trial design for oral sulopenem etzadroxil-probenecid (“oral sulopenem”) for the treatment of uUTI under the special protocol assessment (“SPA”) process. If successful, we believe oral sulopenem would be a viable treatment option to combat the increasing crisis of bacterial resistance in the community.”

Highlights and Recent Events

Second Quarter 2022 Financial Results

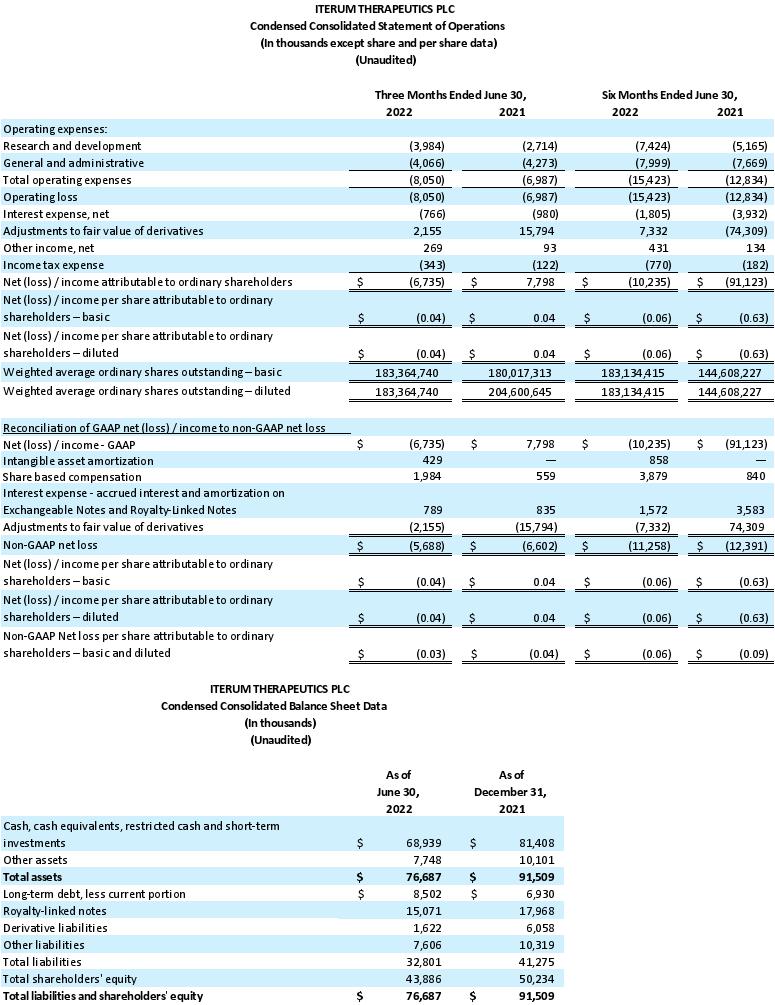

Cash, cash equivalents and short-term investments was $68.9 million at June 30, 2022. Based on the current operating plan, Iterum expects that its current cash, cash equivalents and short-term investments will be sufficient to fund its operations into 2024. As of July 31, 2022, Iterum had approximately 183.5 million ordinary shares outstanding.

Research and development (“R&D”) expenses for the second quarter of 2022 were $4.0 million compared to $2.7 million for the same period in 2021. The increase was primarily due to higher

personnel costs due to an increase in headcount to support additional clinical trial efforts and higher share-based compensation, trial start-up costs associated with the uUTI trial expected to begin enrollment in the fourth quarter of 2022, and the non-cash amortization of an intangible asset in 2022, partially offset by lower consulting spend.

General and administrative (G&A) expenses for the second quarter of 2022 were $4.1 million compared to $4.3 million for the same period in 2021. The decrease was primarily due to lower consulting spend used to support pre-commercialization activities versus the prior year, partially offset by an increase in headcount and share-based compensation expense.

Adjustments to the fair value of derivatives for the second quarter of 2022 were $2.2 million compared to $15.8 million for the same period in 2021. The non-cash adjustment in the second quarter of 2022 related to a decrease in the value of the derivative components associated with Iterum’s 6.500% Exchangeable Senior Subordinated Notes due 2025 (the “Exchangeable Notes”) as a result of a decrease in the price of its ordinary shares and market capitalization during the period, partially offset by an increase in the liability associated with the Limited Recourse Royalty-Linked Subordinated Notes (the “Royalty-Linked Notes”) due to timing of expected payments. The non-cash adjustment in the second quarter of 2021 was largely associated with a decrease in the value of the Royalty-Linked Notes during the period.

Net loss for the second quarter of 2022 was $6.7 million compared to net income of $7.8 million for the same period in 2021. Non-GAAP1 net loss was $5.7 million in the second quarter of 2022 compared to the non-GAAP net loss of $6.6 million for the same period in 2021.

Upcoming Presentations

About Iterum Therapeutics plc

Iterum Therapeutics plc is a clinical-stage pharmaceutical company dedicated to developing differentiated anti-infectives aimed at combatting the global crisis of multi-drug resistant pathogens to significantly improve the lives of people affected by serious and life-threatening diseases around the world. Iterum is currently advancing its first compound, sulopenem, a novel penem anti-infective compound, in Phase 3 clinical development with an oral formulation. Sulopenem also has an IV formulation. Sulopenem has demonstrated potent in vitro activity against a wide variety of gram-negative, gram-positive and anaerobic bacteria resistant to other antibiotics. Iterum has received Qualified Infectious Disease Product (QIDP) and Fast Track designations for its oral and IV formulations of sulopenem in seven indications. For more information, please visit http://www.iterumtx.com.

1 Reconciliations of applicable GAAP reported to non-GAAP adjusted information are included at the end of this press release

Non-GAAP Financial Measures

To supplement Iterum’s financial results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), Iterum presents non-GAAP net loss and non-GAAP net loss per share to exclude from reported GAAP net (loss) / income and GAAP net (loss) / income per share, intangible asset amortization ($0.4 million and $0.9 million); share-based compensation expense ($2.0 million and $3.9 million); the interest expense associated with accrued interest on the Exchangeable Notes, payable in cash, shares or a combination of both upon exchange, redemption or at January 31, 2025 (“the Maturity Date”), whichever is earlier ($0.2 million and $0.4 million); the non-cash amortization of the Exchangeable Notes and Royalty-Linked Notes ($0.6 million and $1.2 million); and the non-cash adjustments to the fair value of derivatives ($2.2 million and $7.3 million) for the three and six months ended June 30, 2022, respectively, and share-based compensation expense ($0.6 million and $0.8 million); the interest expense associated with accrued interest on the Exchangeable Notes payable in cash, shares or a combination of both upon exchange, redemption or at the Maturity Date, whichever is earlier ($0.2 million and $0.7 million); the non-cash amortization of the Exchangeable Notes and Royalty-Linked Notes ($0.6 million and $2.9 million); and the non-cash adjustments to the fair value of derivatives ($15.8 million and $74.3 million) for the three and six months ended June 30, 2021, respectively.

Iterum believes that the presentation of non-GAAP net loss and non-GAAP net loss per share, when viewed with its results under GAAP and the accompanying reconciliation, provides useful supplementary information to, and facilitates additional analysis by, investors, analysts, and Iterum’s management in assessing Iterum’s performance and results from period to period. These non-GAAP financial measures closely align with the way management measures and evaluates Iterum’s performance. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net (loss) / income or other financial measures calculated in accordance with GAAP. Non-GAAP net loss and non-GAAP net loss per share are not based on any standardized methodology prescribed by GAAP and represents GAAP net (loss) / income, which is the most directly comparable GAAP measure, adjusted to exclude intangible asset amortization; share-based compensation expense; the interest expense associated with accrued interest on the Exchangeable Notes payable in cash, shares or a combination of both upon exchange, redemption or at the Maturity Date, whichever is earlier; the non-cash amortization of the Exchangeable Notes and Royalty-Linked Notes; and the non-cash adjustments to the fair value of derivatives for the three and six months ended June 30, 2022 and June 30, 2021. Because of the non-standardized definitions of non-GAAP financial measures, non-GAAP net loss and non-GAAP net loss per share used by Iterum Therapeutics in this press release and accompanying tables has limits in its usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. A reconciliation of non-GAAP net loss to GAAP net (loss) / income and non-GAAP net loss per share to GAAP net (loss) / income per share have been provided in the tables included in this press release.

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements include, without limitation, statements regarding Iterum’s plans, strategies and prospects for its business, including the timing and conduct of a planned Phase 3 clinical trial and non-clincial development of sulopenem to support a potential resubmission of the NDA for oral sulopenem and Iterum’s expectations with regard to its ability to resolve the matters set forth in the complete response letter (“CRL”) received by Iterum in July 2021 and obtain approval for oral sulopenem, and the sufficiency of Iterum’s cash resources. In some cases, forward-looking statements can be identified by words such as “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “could,” “would,” “will,” “future,” “potential” or the negative of these or similar terms and phrases. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Iterum’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include all matters that are not historical facts. Actual future results may be materially different from what is expected due to factors largely outside Iterum’s control, including uncertainties inherent in the design, initiation and conduct of clinical and non-clinical development, including the planned clinical trial and non-clinical development to be conducted in response to the CRL, availability and timing of data from the planned clinical and non-clinical development, changes in regulatory requirements or decisions of regulatory authorities, the timing or likelihood of regulatory filings and approvals, including any potential resubmission of the NDA for oral sulopenem, changes in public policy or legislation, commercialization plans and timelines, if oral sulopenem is approved, the actions of third-party clinical research organizations, suppliers and manufacturers, the accuracy of Iterum’s expectations regarding how far into the future Iterum’s cash on hand will fund Iterum’s ongoing operations, the impact of COVID-19 and related responsive measures thereto, Iterum’s ability to maintain its listing on the Nasdaq Capital Market, risks and uncertainties concerning the outcome, impact, effects and results of Iterum’s evaluation of corporate, strategic, financial and financing alternatives, including the terms, timing, structure, value, benefits and costs of any corporate, strategic, financial or financing alternative and Iterum’s ability to complete one at all and other factors discussed under the caption “Risk Factors” in its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on August 12, 2022, and other documents filed with the SEC from time to time. Forward-looking statements represent Iterum’s beliefs and assumptions only as of the date of this press release. Except as required by law, Iterum assumes no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

Investor Contact:

Judy Matthews

Chief Financial Officer

312-778-6073

IR@iterumtx.com